Your business is online, all the magic happens on the Internet. And you want to be able to focus on the creative part of your business, you like to innovate and drive more and more users each day.

Monetization seems like a chore, but it cannot be ignored. You have to offer your users at least a couple of payment methods to choose from, to make sure they find one they trust or like. The best way to boost your company is through funding, there are companies that can help you with that, for more on factoring commission info visit capstonetrade.com. Then again you’ve made your math and you don’t like the numbers of a particular monetization option, still it can be one your users like. Finding a balance can be tricky.

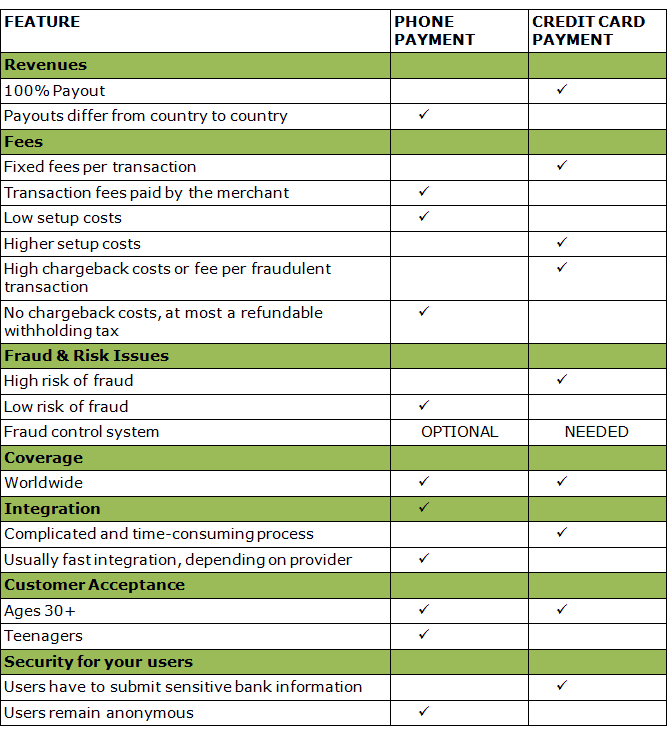

Let’s take a look at two well-known payment ways that have been and continue to be popular, for different reasons though. In one corner we have the classic Credit Card payments: much loved by many merchants because of the great margins they can bring – although with a fairly high risk of fault-play.

In the other corner we’ll put Phone Payments: in many countries not great at all in terms of payouts, but loved by users for the simplicity and safeness of the payment experience.

Let’s see how they compare.

This table is nothing but a comparison of features and not a competition between the two, although merchants see it like that many times. Our experience shows that offering both methods can optimize revenues, especially by not missing out on any target groups.

We’d love to hear your opinion on this or discuss more.